It’s still a strong seller’s market throughout nearly all of Greater Philadelphia, with homes selling quickly and for top dollar! Due to a relatively low inventory of homes for sale and a growing number of buyers, competition for existing homes remains fierce. In fact, a number of recent EveryHome listings received more than ten written…

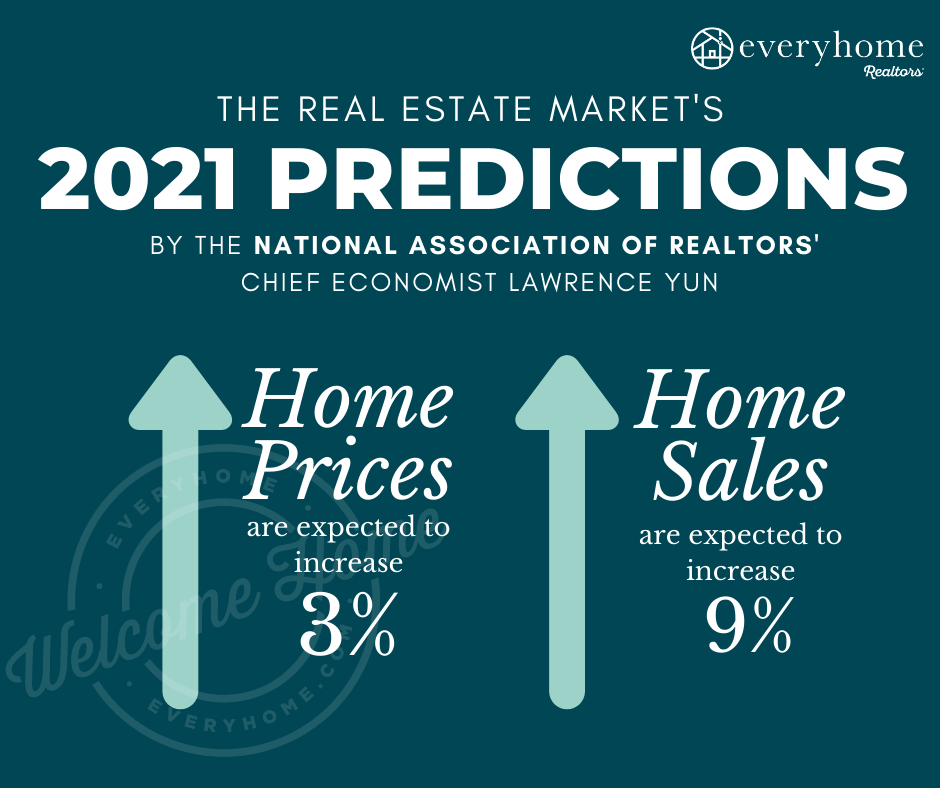

With 2021 upon us, leading economic experts are making predictions with what we can expect to see in the coming months. Dr. Lawrence Yun, the Chief Economist for the National Association of Realtors®, anticipates a year of continued growth for the housing market. The top economist expects to see 9% growth in year-over-year home sales…

Home loans are cheaper than ever, thanks in part to a tumultuous economy plagued by Covid-19. Mortgage rates are currently hovering around 3%, and government mortgage giant Freddie Mac recently reported its lowest-ever rates in the last month. The average 30-year fixed rate loan is 2.87% (which includes 0.8 points, which is a fee paid…

If you’re planning to purchase a home in the coming year, you may be wondering how to hire a buyer’s agent – and if you really need one at all. While it’s certainly possible to find a home on your own and work with the listing agent, the vast majority of buyers are represented by…

EveryHome agent and resident fitness enthusiast Jennifer Clark shares some of her favorite home workout ideas – all while staying safe and socially distanced: Starting a workout program at home? You don’t have to own a home gym or anything close to it. Just find a platform that you love – and they are literally…

Now that we have been at home for an extended length of time, adding all-day events like distance schooling, three meals a day, working from home, and no gyms or sports – here is a question. How big of a home do you really need? We haven’t been able to entertain, so have you put that…

Tiny homes are having a big moment! With their budget-friendly price tags, smaller carbon footprint, and cozy appeal, it’s no surprise that more and more home buyers are looking for tiny homes. But how much can you expect to really spend? First, it’s important to mention that “tiny homes” can be super diverse! One of the most…

As a small business, we understand that it’s more important than ever to save money. That’s why we’re offering full-service listings for a total commission of just 4% this spring. On a $300,000 home, that will help you keep an extra $6,000 of your hard-earned equity compared to most of our competitors. In light of…

While Governor Wolf’s mandate required that businesses’ physical office locations temporarily close during this uncertain time, we are fortunate at EveryHome that all of our agents have worked from home since 1999. As a result, we are open for business and available to assist you with all of your real estate needs or any questions…

The upcoming spring real estate season is the perfect time to sell for thousands of homeowners across Greater Philadelphia. In addition to being a “Seller’s Market” in the vast majority of neighborhoods, be sure to consider the following: New Buyers Are Still Entering the MarketIf your home is considered in the entry-level or mid level…

For those who don’t know what’s happened in my life this past year, it’s been a tough one. My mom passed away in April 2019. My siblings and I were tasked with the BIG job of selling the family home. It was an emotional process, clearing out 59 years of family life. With blood, sweat…

Note: Pernilla Marsh is an EveryHome agent who was born and raised in southwestern Sweden. Below, she shares with us the art of creating hygge in an American home. Hygge is a word that has become trendy and many articles have been written about it. It’s a Danish word and there is no real translation…

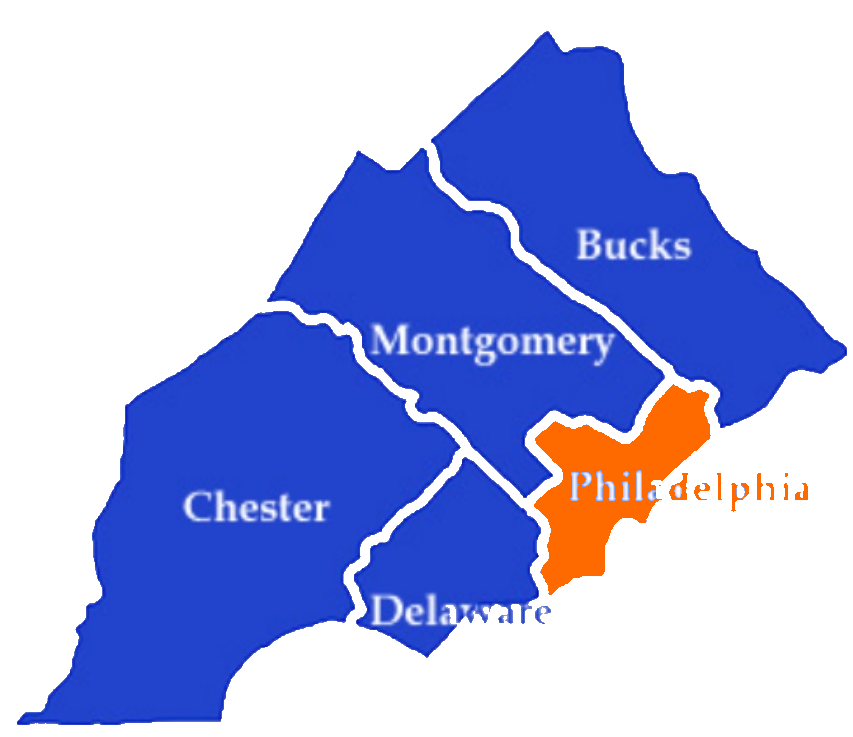

Good news for those living in Montgomery, Chester, and Delaware counties! The commissioners in three of the most populous suburban counties approved budgets for 2020 that do not include any real estate tax increases. Bucks County is the only local suburban area that will see an increase in 2020, but the changes will be modest….

The world’s foremost color authority, Pantone, chose a crisp, cool hue of blue for its 2020 Color of the Year, aptly dubbed “Classic Blue”. A simple and timeless choice (especially considering the bold and unusual choices of the last few years), Pantone explained that the shade is intended to instill “calm, confidence, and connection” during…

The year is coming to a close, but there’s still time to move into your new home just in time for the holidays and new year! The holiday season tends to be one of the best times of year for buying a home affordably, as sellers are motivated to close prior to the end of…