Contemporary homes come in all shapes and sizes, but typically feature clean lines, asymmetrical shapes, expansive windows, and a modern design. If you’re interested in buying an efficient, unique home in 2017, look no further than the following three options: An affordable and spacious artist’s retreat, this gorgeous mid-century home features an open floor plan…

Owning your home comes with lots of privileges….and responsibilities. In 2019, we resolve to make our homes safer, cleaner, and more affordable – and here’s how we plan to do it: 1. We bet you’ve been saying you’ve wanted a home alarm system forever, right? We know this because we’ve been saying it, too – and…

If your New Year’s Resolution is to buy your first home, you’re not alone! In fact, real estate agents anticipate that first-time buyers and Millennials will make up the largest share of home shoppers in 2017. While predicting the real estate market is notoriously difficult, industry experts warn that 2017 might be even more unpredictable…

Whether you’re interested in selling, refinancing, or taking out a home equity line of credit (HELOC), you’ll need to know the amount of equity that you have in your home. The first step is to take a look at your monthly mortgage statement to get a sense of your outstanding balance. If you’re like most…

Dear Santa, We’ve been really good this year (and sold more houses than ever before!). Here’s what we’d love for Christmas this year: 1. We know the interest rates are increasing because the economy is recovering, but can you please keep them below 4.5% for the busy buying season of 2017? It’ll help our buyers…

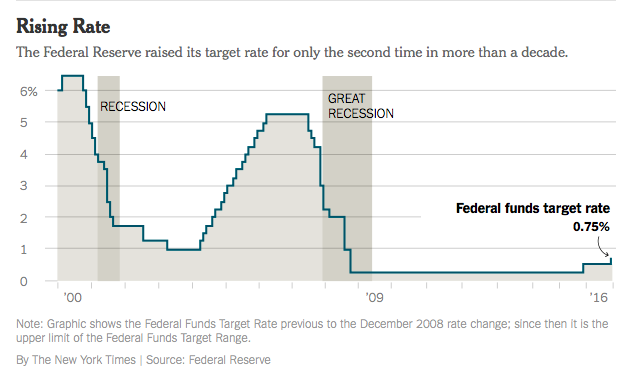

The Federal Reserve voted to raise the benchmark interest rate one-quarter of a percent on Wednesday, signaling a future uptick in mortgage rates. The unanimous decision, which was widely predicted by industry experts, was only the second time in a decade that the Federal Reserve raised interest rates. Explains Janet Yellen, the Fed’s chairwoman, “My…

We’ve all been there. Whether it’s an impromptu get-together, a holiday party that your spouse forgot to tell you about, or a last-minute housewarming soiree, we’ve forgotten a small token of appreciation for the host or hostess….and, inevitably, found ourselves picking up a mediocre bottle of wine at the liquor store on the way to…

Mark Mawby was kind enough to sit down with EveryHome and discuss how to afford a mortgage with student loan debt. Mark serves as the Vice President of Lending for Freedom Mortgage in Plymouth Meeting, PA and his team has helped countless EveryHome buyers effortlessly secure a mortgage. There have been a lot of changes…

The housing markets of 2015 and 2016 enjoyed record real estate sales, skyrocketing home values, and historically-low interest rates. Now that most economic indicators suggest that the real estate market has shifted back toward normal, experts are predicting that 2017 will be a year of modest, steady growth and rising interest rates. While first-time homebuyers were originally…

Mortgage rates haven’t been this high since October 2014. Government mortgage giant Freddie Mac recently reported that the average 30-year fixed rate loan has climbed from 4.08% to 4.13% this week. These figures include an average of 0.5 points (a point is an upfront fee paid to the lender by the borrower to “buy down”…

There are plenty of new construction communities in Greater Philadelphia, ranging in price from $150,000 up to multimillion dollar homes. Buying a brand new home is a little bit different, though, so there are a few things to keep in mind before you begin the process. One of the most important things to consider is…

Think “bigger is better”? Not always the case! Whether you’re looking to save money and time, have a smaller carbon footprint, or simplify your lifestyle, you’re not alone — thousands of homeowners in Greater Philadelphia choose to downsize their home each year! Of course, there are varying degrees of downsizing, and it certainly isn’t for…

September’s data was recently released, and the nation’s average home value has now surpassed the peak of the housing bubble in 2006. The closely-watched S&P Case-Shiller 20-city Index reported an increase of 5.1% from September 2015 to September 2016, an upward tick resulting in home values that the nation hasn’t seen since before the Great Recession….

If your friend or family member recently purchased their first home, you may be wondering what kind of gift they’d appreciate this winter season. Whether it’s for a housewarming party or holiday swap, the following ideas are always a hit with new homeowners! Homeownership (and moving!) is stressful, so we love the idea of giving…

Often times, people use the term “Realtor®” and “real estate agent” interchangeably — even in the industry! There is a distinct difference, though, and it’s pretty straightforward. A real estate agent simply refers to someone who is licensed as a real estate salesperson through their state. All states require licensed agents to take courses and…