If you’re in the process of purchasing a home, it just might be the perfect time to lock in your interest rate! The nation’s average 30-year fixed rate mortgage rate fell to 3.70%, the lowest since late 2016 according to Mortgage News Daily. Economists speculate that rates could fall even lower in the upcoming week,…

A recent shift by Freddie Mac and Fannie Mae made it easier for borrowers with higher levels of debt to obtain a home loan. The government-backed mortgage giants announced that it will begin accepting borrowers with debt-to-income (DTI) ratios up to 50%. Previously, lenders were only accepting DTI ratios up to 45%. This policy change is…

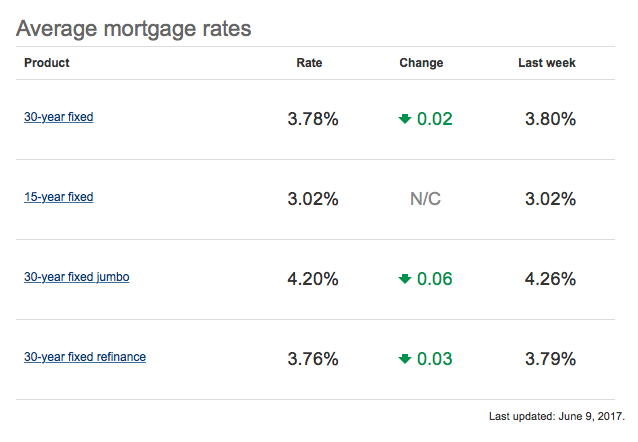

Mortgage rates slid lower for the fourth week in a row and fell to their lowest levels since November, prompting borrowers with upcoming settlements to lock in their interest rates. Currently, the national average for the benchmark 30-year fixed loan stands at 3.78%, down two basis points from this time last week. The average 15-year…

The average 30-year fixed rate mortgage dropped to 3.85% this week, according to Bankrate.com. A decrease of 8 basis points since this time last week, some lenders have encouraged borrowers to lock in their rates. The average 15-year fixed rate home loan dropped 6 basis to 3.07%, and the 5/1 Adjustable Rate Mortgage (ARM) also…

The real estate market is hot in Greater Philadelphia, and competition is fierce among buyers in many suburban neighborhoods. It’s especially tough for buyers who have a home to sell, as many sellers are less likely to accept offers with a home sale contingency. However, there are options for these buyers, and one of them is…

Interested in buying a home this spring but concerned about your credit? You’re not alone! Each year, we work with dozens of buyers who struggle to qualify for a mortgage because of poor credit. Luckily, there are local, helpful programs to help borrowers increase their credit scores quickly! Currently, FHA mortgages allows buyers with credit…

Good news for buyers using an Federal Housing Administration (FHA) loan and making a down payment of less than twenty percent! Annual mortgage insurance premiums just dropped significantly in price, from 0.85% to 0.6% of the loan balance. The recent change, announced January 9th, is expected to save the average homeowner approximately $500 per year. The…

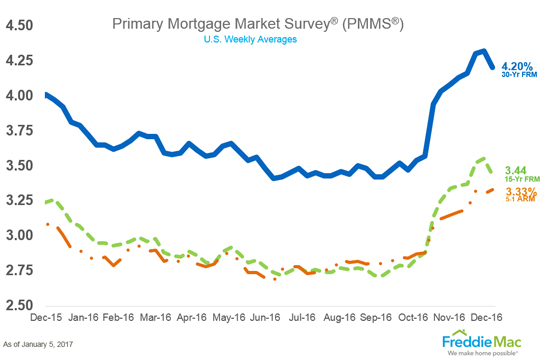

Breaking a 9-week streak of increasing mortgage rates, the average 30-year fixed loan tumbled this week to 4.20%. Last week, the average rate stood at 4.32%. Government mortgage agency Freddie Mac reported that mortgage rates have fallen for the first time since the presidential election, and that the 15-year fixed rate loan and 5/1 Adjustable-Rate Mortgage…

Whether you’re interested in selling, refinancing, or taking out a home equity line of credit (HELOC), you’ll need to know the amount of equity that you have in your home. The first step is to take a look at your monthly mortgage statement to get a sense of your outstanding balance. If you’re like most…

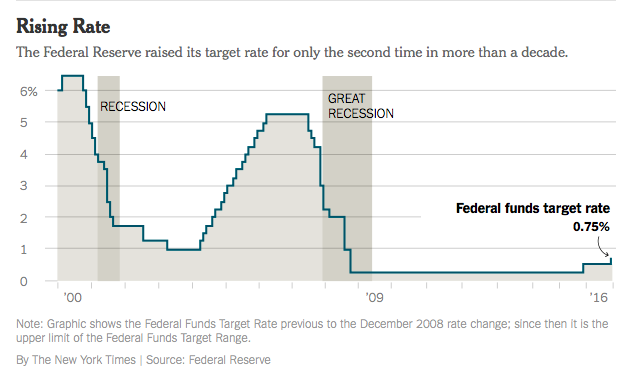

The Federal Reserve voted to raise the benchmark interest rate one-quarter of a percent on Wednesday, signaling a future uptick in mortgage rates. The unanimous decision, which was widely predicted by industry experts, was only the second time in a decade that the Federal Reserve raised interest rates. Explains Janet Yellen, the Fed’s chairwoman, “My…

Mark Mawby was kind enough to sit down with EveryHome and discuss how to afford a mortgage with student loan debt. Mark serves as the Vice President of Lending for Freedom Mortgage in Plymouth Meeting, PA and his team has helped countless EveryHome buyers effortlessly secure a mortgage. There have been a lot of changes…

The average 30-year fixed rate mortgage jumped another 6 basis points this past week to 4.02%, Bankrate.com reports. Fueled by industry expectations that a Trump presidency will increase corporate profits and cut taxes, the increase in rates have been an unwelcome surprise to buyers across the country. Just a month ago, the average home loan…

A lot of buyers, and especially first-time buyers, are unsure how much money they should put down on their new home. Down payment amounts can vary greatly among borrowers, and the majority of EveryHome clients put down between 3.5% and 20%. And sometimes there are even opportunities to buy a home with 0% down –…

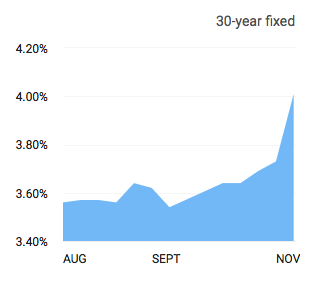

Mortgage rates jumped above the 4 percent benchmark in the week following the election, and many industry experts are advising buyers to lock their rate immediately. Despite being the biggest one-week increase in over three years, the market remains volatile and rates may continue to rise quickly. While we haven’t seen rates above 4 percent since…

If you or your spouse is an active United States military member or veteran, you may be eligible for a Veterans Affairs (VA) loan. VA loans are a popular type of mortgage for veterans because they offer loans for 0% down payment and do not require mortgage insurance. Additionally, VA loans generally have fewer upfront…