If your friend or family member recently purchased their first home, you may be wondering what kind of gift they’d appreciate this winter season. Whether it’s for a housewarming party or holiday swap, the following ideas are always a hit with new homeowners! Homeownership (and moving!) is stressful, so we love the idea of giving…

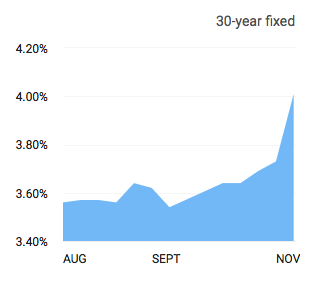

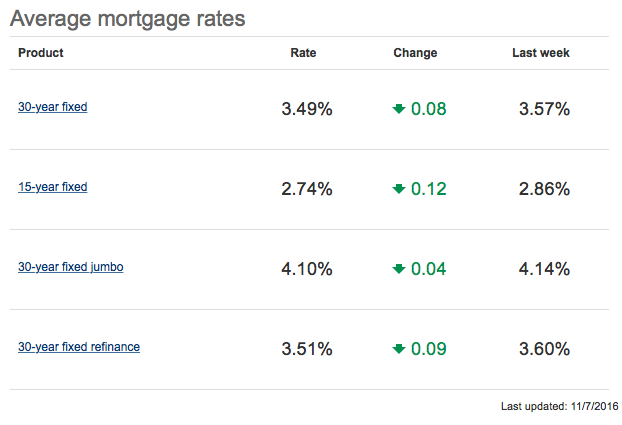

The average 30-year fixed rate mortgage jumped another 6 basis points this past week to 4.02%, Bankrate.com reports. Fueled by industry expectations that a Trump presidency will increase corporate profits and cut taxes, the increase in rates have been an unwelcome surprise to buyers across the country. Just a month ago, the average home loan…

A lot of buyers, and especially first-time buyers, are unsure how much money they should put down on their new home. Down payment amounts can vary greatly among borrowers, and the majority of EveryHome clients put down between 3.5% and 20%. And sometimes there are even opportunities to buy a home with 0% down –…

If you’re in the process of selling your home, you may be wondering if it’s appropriate to decorate for the holidays. Generally speaking, we think that it’s a great idea to add a few holiday touches to your home. A festive tree, a menorah in the window, or sparkly lights around the mantle can all transform your…

Mortgage rates jumped above the 4 percent benchmark in the week following the election, and many industry experts are advising buyers to lock their rate immediately. Despite being the biggest one-week increase in over three years, the market remains volatile and rates may continue to rise quickly. While we haven’t seen rates above 4 percent since…

If you or your spouse is an active United States military member or veteran, you may be eligible for a Veterans Affairs (VA) loan. VA loans are a popular type of mortgage for veterans because they offer loans for 0% down payment and do not require mortgage insurance. Additionally, VA loans generally have fewer upfront…

Mortgage rates dropped yet again, and buyers across the country are carefully watching the market to see if rates will increase sharply before the busy spring market. While it’s hard to accurately predict rates more than six months in advance, industry experts speculate that they won’t climb above 4% in 2017. The nation’s most popular…

The holiday season is busy enough as-is, but it can feel even crazier if you’re also actively looking for a new home! While the real estate market typically slows down in November and December, this year is far busier than most. This is likely because the spring market was so competitive, and as a result,…

If you browse for homes on other real estate websites, you might occasionally see a home being marketed as a “Pre-Foreclosure.” Here’s what you need to know: 1. Pre-Foreclosure homes are not technically for sale….at least, not yet. When a homeowner is more than 90 days late on his or her mortgage payment, they are issued…

It’s no secret that professionally staged homes sell faster and for more money, but unfortunately this option isn’t accessible for the vast majority of homeowners. The price of rental furniture can add up, and the time-consuming suggestions by an interior designer aren’t feasible for many sellers. That’s where Haven comes in. The dream of owners Diane Quercetti…

Did you know that Philadelphia is considered one of the most haunted cities in America? With its rich history and spooky sites, it’s no surprise that there are dozens of haunted houses in Philly and the suburbs. Interestingly, some states require that “stigmatized property” (which may include paranormal activity) be disclosed by sellers. However, sellers…

Is fall the new spring when it comes to the real estate market? As borrowers rush to refinance or purchase their new home before November 8th, lenders around the country have been busy processing mortgage applications in time for Election Day. Spring tends to be the busiest time of year for the real estate market,…

You’ve probably heard stories about people who own attractive four-bedroom homes but struggle to afford their credit card bills, utilities, or even their weekly groceries. Unfortunately, this scenario is more common than you might think, and it’s referred to as being “house poor”. It typically occurs when homeowners spend a large proportion of their income on their…

If you’re lucky enough to be considering a second home purchase, you just may want to pull the trigger this fall. Industry experts suggest that the cooler months of October, November and December are the best time to settle on a vacation home, as prices tend to be lower. Plus, the supply of homes for sale…

Gone are the days of needing 20% down! Instead, lenders are touting low down payment options for qualified borrowers, and some loans don’t even require a down payment. For example, the popular FHA mortgage offers loans for just 3.5% down, and USDA and VA loans don’t require their borrowers to put any money down. Today, the average…