Mark Mawby was kind enough to sit down with EveryHome and discuss how to afford a mortgage with student loan debt. Mark serves as the Vice President of Lending for Freedom Mortgage in Plymouth Meeting, PA and his team has helped countless EveryHome buyers effortlessly secure a mortgage. There have been a lot of changes…

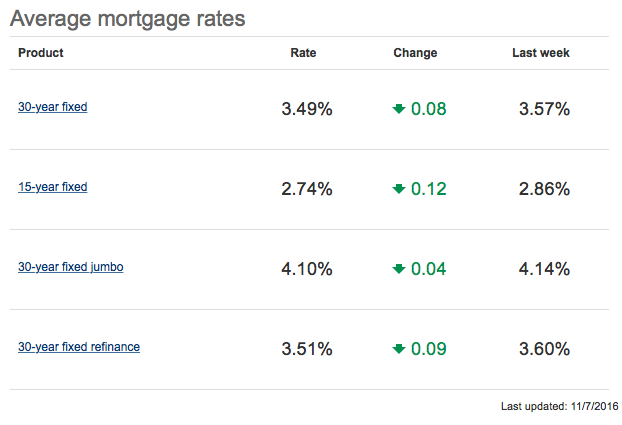

The average 30-year fixed rate mortgage jumped another 6 basis points this past week to 4.02%, Bankrate.com reports. Fueled by industry expectations that a Trump presidency will increase corporate profits and cut taxes, the increase in rates have been an unwelcome surprise to buyers across the country. Just a month ago, the average home loan…

A lot of buyers, and especially first-time buyers, are unsure how much money they should put down on their new home. Down payment amounts can vary greatly among borrowers, and the majority of EveryHome clients put down between 3.5% and 20%. And sometimes there are even opportunities to buy a home with 0% down –…

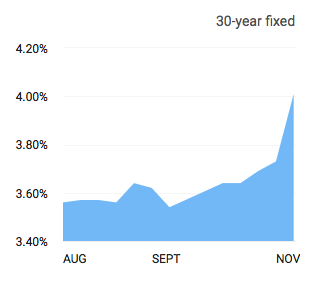

Mortgage rates jumped above the 4 percent benchmark in the week following the election, and many industry experts are advising buyers to lock their rate immediately. Despite being the biggest one-week increase in over three years, the market remains volatile and rates may continue to rise quickly. While we haven’t seen rates above 4 percent since…

If you or your spouse is an active United States military member or veteran, you may be eligible for a Veterans Affairs (VA) loan. VA loans are a popular type of mortgage for veterans because they offer loans for 0% down payment and do not require mortgage insurance. Additionally, VA loans generally have fewer upfront…

Mortgage rates dropped yet again, and buyers across the country are carefully watching the market to see if rates will increase sharply before the busy spring market. While it’s hard to accurately predict rates more than six months in advance, industry experts speculate that they won’t climb above 4% in 2017. The nation’s most popular…

When you purchase a home with a mortgage, your monthly payment will likely include your loan’s principal and interest, as well as property taxes, homeowners’ insurance, and private mortgage insurance (if applicable). If you’ve owned a home before, this information probably sounds familiar. If you’re a first time buyer, however, this can be a little counterintuitive…

Is fall the new spring when it comes to the real estate market? As borrowers rush to refinance or purchase their new home before November 8th, lenders around the country have been busy processing mortgage applications in time for Election Day. Spring tends to be the busiest time of year for the real estate market,…

Gone are the days of needing 20% down! Instead, lenders are touting low down payment options for qualified borrowers, and some loans don’t even require a down payment. For example, the popular FHA mortgage offers loans for just 3.5% down, and USDA and VA loans don’t require their borrowers to put any money down. Today, the average…

It’s common knowledge that borrowers must have an average or above-average credit score to purchase a home. However, credit scores are far more important when purchasing a home than you might think, as only buyers with the highest scores are eligible for the lowest interest rates. While borrowers with credit scores above 760 are most likely to receive the…

Mortgage rates had been stuck around 3.4% for much of the summer, but they finally took their biggest leap in over two months this week. While they only increased about an eighth of a percent, it was enough to hurt stocks of the nation’s top homebuilders. Significant increases in the average mortgage rate can send shockwaves throughout…

Mortgage rates inch higher this week after Federal Reserve Chair Janet Yellen announced that U.S. interest rates may rise later this year. Currently, the average 30-year fixed rate loan stands at 3.46% according to Freddie Mac, up from last week’s average of 3.43%. Yellen cited the strong labor market and promising economic outlook and inflation as…

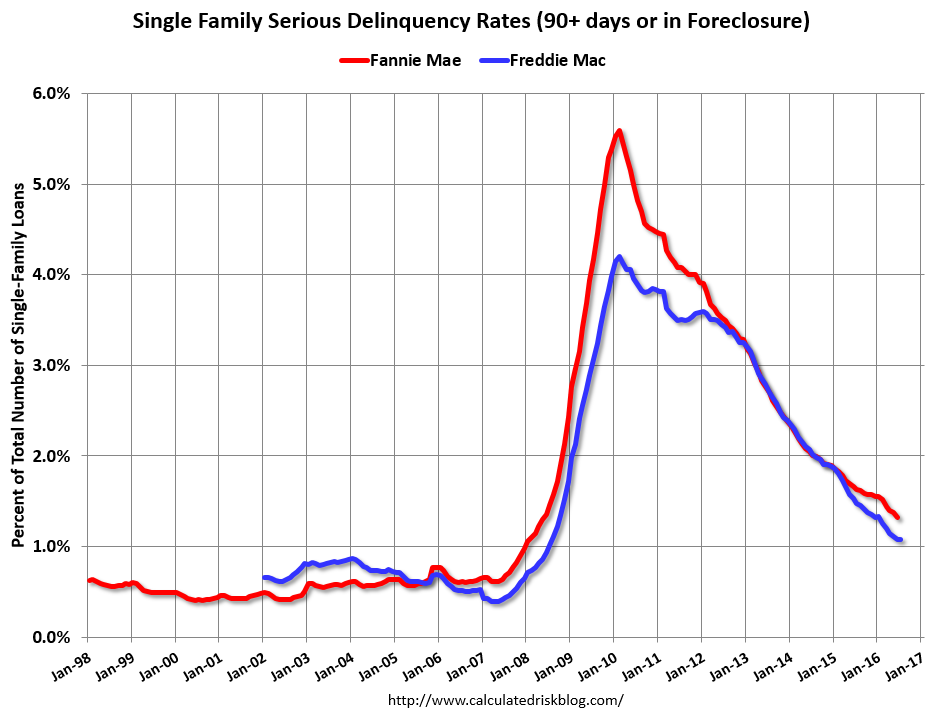

The number of households in the United States that are “seriously” delinquent on their mortgage payments has fallen since this time last year, according to Freddie Mac. In the latest piece of good news for the housing market, the government mortgage giant reports that just 1.08% of homeowners are three months behind on their mortgage…

If you’re in the process of buying a home and securing a mortgage, you may have seen both the interest rate and annual percentage rate (APR) expressed on various websites and forms. While they’re similar, there are a few key differences — and they’re definitely not interchangeable terms. Here’s what you need to know: …

While mortgage rates remain historically low, they’re beginning to climb slightly for the first time following the Brexit vote. Currently, the average 30-year fixed rate mortgage stands at 3.42%. The national average rate plummeted following the UK’s announcement, and some industry experts even speculated that they may drop to their lowest rate ever. While that…