If you’re in the market for a luxury home, you’ll likely be obtaining a jumbo mortgage. This type of loan covers homes that “exceed the conforming limit,” which is usually $417,000 (note: in some areas of New Jersey, the limit is $625,000).

Qualifying for a jumbo loan is a bit different than securing any other type of mortgage, and most lenders have stricter requirements. Here’s what you can expect:

1. You’ll need a higher credit score. While many lenders require a minimum FICO score of just 600 to secure an FHA loan, Jumbo loan borrowers need to show greater financial credibility. Instead, you’re likely to need a credit score of at least 680, although 700+ is preferred.

2. A greater down payment may be required. You can expect to put down at least 15% of the purchase price on your luxury home, according to Bankrate.com, although some lenders prefer down payments of at least 20% or 25%.

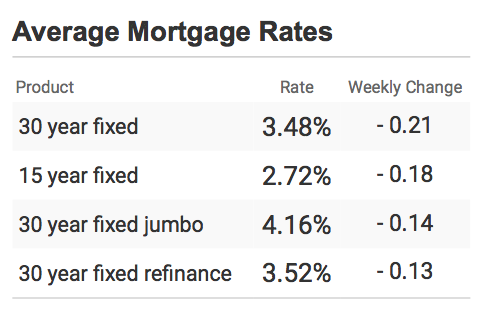

3. Be prepared for slightly higher interest rates. Currently, buyers can expect to lock in slightly higher interest rates for their jumbo loans, although these percentage points fluctuate daily. Generally speaking, jumbo loans tend to come with higher interest rates because they’re not government-backed and, as a result, considered a bit more risky on the secondary mortgage market. Interestingly, though, rates on jumbo loans were actually cheaper than FHA rates just a couple of years ago – so it all depends on the market!