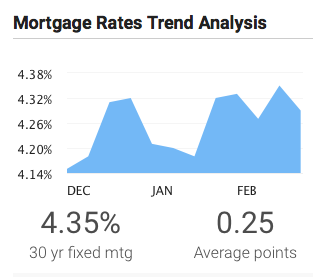

The average 30-year fixed rate home loan climbed higher this past week, according to Bankrate.com. Homebuyers can now expect to lock in a mortgage rate around 4.35%, up 8 basis points from the previous week. The average rate includes “points” which are an upfront fee paid in exchange for a reduced interest rate; if you don’t purchase any points, you may incur a higher interest rate.

While the 30-year fixed rate mortgage is the most popular option, some buyers prefer the 5/1 Adjustable Rate Mortgage (ARM) which also floated up 5 basis points to 3.51%. For homebuyers who plan on living in the home for less than five years, this may be the most affordable loan type.

To learn more about financing options and get pre-approved for a home loan, be sure to give us a call at (215) 699-5555. We would love to introduce you to a local, helpful loan officer.