If you currently own your home and are planning to refinance, now may be the time. While the total number of mortgage applications decreased this past week, the number of homeowners refinancing increased significantly. This is likely due to an expected rate increase, following a possible announcement from the Fed that they will be raising the Federal Funds Rate.

Rates are expected to climb in 2016, with industry experts predicting that the 30-year fixed rate loan will exceed 5% within a year. This rate increase could cost the average homeowner over $100 more on each monthly payment.

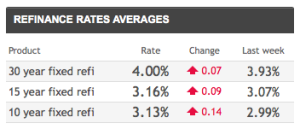

The current average 30-year fixed rate mortgage is currently hovering around 4%. The 15-year fixed rate loan, which is the most popular choice for people refinancing, remains around 3.15-3.25%.