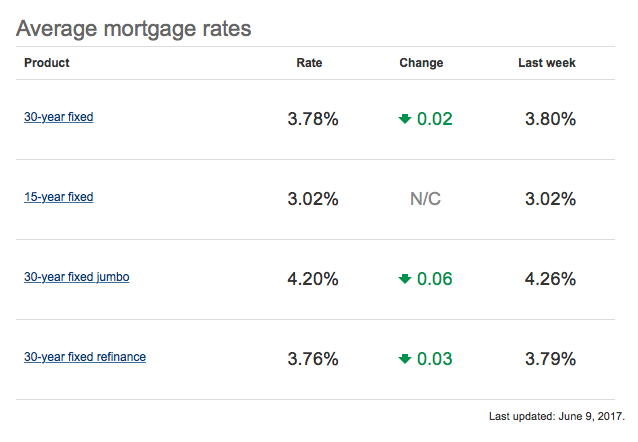

Mortgage rates slid lower for the fourth week in a row and fell to their lowest levels since November, prompting borrowers with upcoming settlements to lock in their interest rates. Currently, the national average for the benchmark 30-year fixed loan stands at 3.78%, down two basis points from this time last week. The average 15-year fixed loan remains unchanged from last week at 3.02%.

If you’re obtaining a mortgage to purchase a luxury home, however, you can expect to pay a higher rate. The average 30-year fixed “Jumbo Loan” stands at 4.20%, and applies to buyers who borrow $417,000 or more.

As a result of the affordable rates, mortgage applications spiked 7.1% since just last week. The purchase application volume hit its highest levels since May 2010, and refinance applications also jumped. If you’re interested in learning more about how to obtain a loan for your new home, be sure to give us a call at (215) 699-5555!