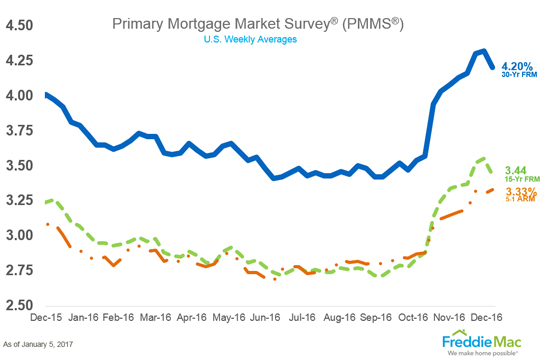

Breaking a 9-week streak of increasing mortgage rates, the average 30-year fixed loan tumbled this week to 4.20%. Last week, the average rate stood at 4.32%. Government mortgage agency Freddie Mac reported that mortgage rates have fallen for the first time since the presidential election, and that the 15-year fixed rate loan and 5/1 Adjustable-Rate Mortgage (ARM) have decreased as well.

Lenders remain undecided on where mortgage rates are headed. Bankrate.com’s weekly mortgage trend index found that experts are mixed on whether rates will continue to fall, remain steady, or rise once again. As the chief financial analyst of Bankrate, Greg McBride, explains, “The run-up in bond yields and mortgage rates the last two months of 2016 was too much, too soon, and not based on anything concrete.”

The weeks surrounding the holidays tend to be a fairly slow time for mortgage applications to begin with, but local lenders are reporting they’re slower than usual – especially in regards to homeowners refinancing. While mortgage rates appear to be stabilizing, they are still 23 basis points higher than this time last year and, as a result, even fewer homeowners are choosing to refinance their properties.