Good news for homeowners: November’s real estate market data was recently released by the S&P Case-Shiller Index and home prices climbed 5.6%. That’s a slight increase from October’s gain of 5.5%. It’s important to note, however, that the biggest gains were made in the West (namely in Seattle, Portland, and Denver), while home prices in…

Tiny homes are having a big moment! With their budget-friendly price tags, smaller carbon footprint, and cozy appeal, it’s no surprise that more and more home buyers are looking for tiny homes. But how much can you expect to really spend? First, it’s important to mention that “tiny homes” can be super diverse! One of the most…

If you’re currently in the market to buy a new home, you probably know how important it for a listing to have clear, realistic, and well-lit photos. After all, 98% of all buyers begin shopping for a home online and first impressions matter. As one real estate agent said, picture appeal is the new curb…

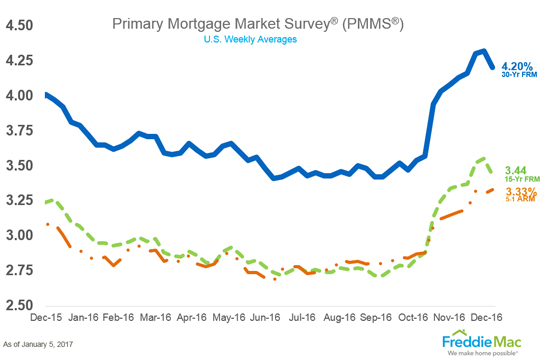

The average mortgage rate jumped ten basis points during the week of the presidential inauguration, and prompted some lenders to speculate that rates will hit 5% by the summertime. The current 30-year fixed rate home loan stands at 4.19% with an average of 0.4 points (points are fees paid to a lender that are equal…

There are a variety of reasons that homeowners need to know their exact property lines, including building a fence, adding a swimming pool, or simply being concerned that a neighbor is encroaching on their yard. Regardless of the reason, there are a few steps that homeowners can take to determine the boundaries of their yard….

This picturesque town of Kennett Square in southern Chester County offers plenty of modest, move-in ready two or three bedroom townhomes. The majority of single homes start around $300,000, but occasionally a fixer-upper will hit the market for a more affordable price – and they tend to be a great value! Pictured: 183 Cambridge Circle, Kennett Square …

One of the most popular school districts in the region, Central Bucks is a large, award-winning district serving nearly 20,000 students! Central Bucks routinely scores in the top ten districts in the state for achievement-based test scores, and it’s powerhouse athletic program has even produced a number of professional athletes. The district serves the Doylestown…

If you’re planning on selling your home in 2017, you might be wondering how long the process is expected to take. Currently, the average home across the nation is on the market for approximately 65 days before going under contract with a buyer, although this length of time can vary greatly! In general, homes sell quickly…

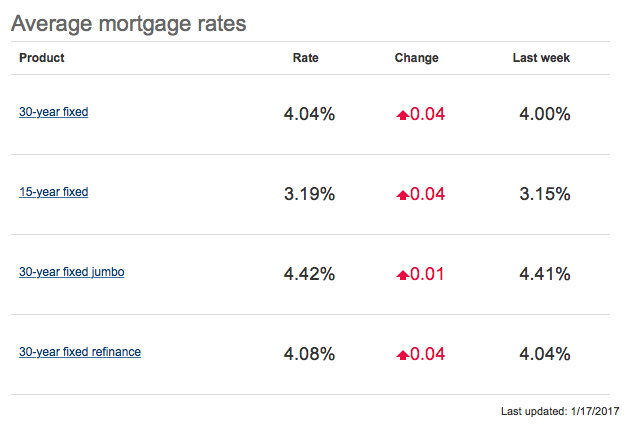

Lenders across the nation reported a slight increase in mortgage rates on Monday, January 17th. The average 30-year fixed rate loan jumped 4 basis points this week to 4.04%, while the average 15-year fixed rate loan climbed to 3.19%. Following November’s election, mortgage rates surged nearly half of a percent higher, but appear to have stabilized…

Some homes have a good chance of selling any time of the year, whereas other homes sell more easily during the spring and summer months. As EveryHome agent and home-flipping guru Jen Kuznits explains, “If you buy a 4-bedroom home in a good school district, with higher taxes, you will typically have a much harder time selling it if…

Do you prefer the customizable, shiny “newness” of a brand new house? Or would you rather move into a character-filled and quaint pre-existing home? According to a survey by Trulia, approximately 41% of homebuyers prefer new construction if the costs were the same, whereas only 21% prefer an existing home, and 38% reported no preference….

Good news for buyers using an Federal Housing Administration (FHA) loan and making a down payment of less than twenty percent! Annual mortgage insurance premiums just dropped significantly in price, from 0.85% to 0.6% of the loan balance. The recent change, announced January 9th, is expected to save the average homeowner approximately $500 per year. The…

Breaking a 9-week streak of increasing mortgage rates, the average 30-year fixed loan tumbled this week to 4.20%. Last week, the average rate stood at 4.32%. Government mortgage agency Freddie Mac reported that mortgage rates have fallen for the first time since the presidential election, and that the 15-year fixed rate loan and 5/1 Adjustable-Rate Mortgage…

Whenever you purchase a home, we always recommend having a home inspection performed on the home prior to settlement. In the harsh winter weather, however, there are some unique challenges and even some benefits, when it comes to winter home inspections. Certified home inspectors are trained to complete thorough inspections, even in the wintertime. Sometimes,…

If you’re “underwater” or “upside-down” on your home, you owe more than it’s worth. For example, if you still owe $220,000 on your mortgage, and your home’s approximate value (as estimated by a licensed real estate agent or appraiser) is $210,000, then you’re about $10,000 underwater. For homeowners in this situation, it’s not a big deal…