Bring the whole family to the Philadelphia Comcast Building for their popular Holiday Spectacular! The beautiful event is running until New Year’s Day, and features dancers from the Pennsylvania Ballet, a beautiful light show, and spirited music. Each show runs at the top of the hour (from 10am-8pm) and lasts approximately fifteen minutes. Head…

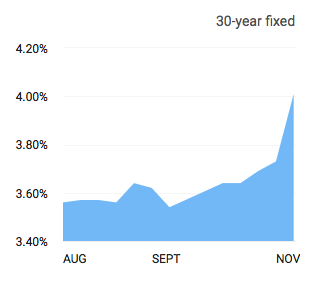

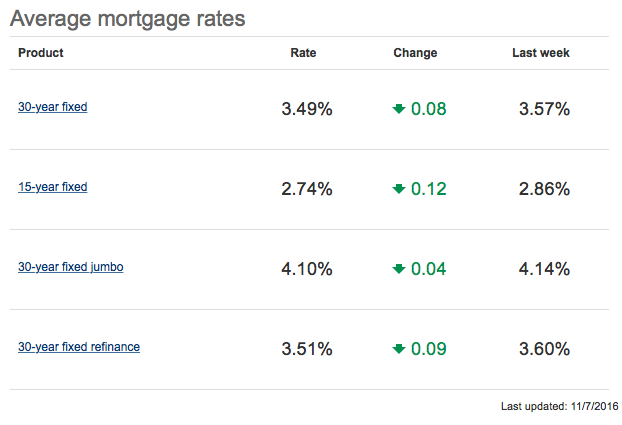

The average 30-year fixed rate mortgage jumped another 6 basis points this past week to 4.02%, Bankrate.com reports. Fueled by industry expectations that a Trump presidency will increase corporate profits and cut taxes, the increase in rates have been an unwelcome surprise to buyers across the country. Just a month ago, the average home loan…

A lot of buyers, and especially first-time buyers, are unsure how much money they should put down on their new home. Down payment amounts can vary greatly among borrowers, and the majority of EveryHome clients put down between 3.5% and 20%. And sometimes there are even opportunities to buy a home with 0% down –…

If you’re in the process of selling your home, you may be wondering if it’s appropriate to decorate for the holidays. Generally speaking, we think that it’s a great idea to add a few holiday touches to your home. A festive tree, a menorah in the window, or sparkly lights around the mantle can all transform your…

We’re so excited for Thanksgiving and upcoming holidays, and we have a lot to be thankful for – especially because 2016 has been our busiest year yet! It’s all due to our dedicated, friendly, and knowledgeable agents. We’re lucky to have an amazing crew of Realtors and support staff! We’re also grateful to have added over…

Situated alongside the Morris Arboretum in Philadelphia’s esteemed Chestnut Hill section, this historic French-style home features a cozy library with original architectural details and an indoor garden. Adjacent to the library is an elegant sunroom overlooking the meticulously landscaped side yard. 9489 Meadowbrook Ave – Offered for $1.575m This charming farmhouse in quiet Upper Bucks,…

Mortgage rates jumped above the 4 percent benchmark in the week following the election, and many industry experts are advising buyers to lock their rate immediately. Despite being the biggest one-week increase in over three years, the market remains volatile and rates may continue to rise quickly. While we haven’t seen rates above 4 percent since…

If you’re thinking about becoming a real estate agent, you’ve probably been reading quite a bit online or talking to family and friends about the decision. And, like with many industries, there are a lot of myths out there! In regards to the process of becoming a real estate agent, there are a couple of misconceptions. …

EveryHome agent and resident home-flipping guru Jen Kuznits has enjoyed a lot of success flipping homes alongside her husband, Tamir. But it’s a tough industry, and not every home is a slam dunk! Here, Jen shares a few things that she wishes she would have known: We once bought a ‘3 bedroom 2 full bathroom’ condo…

It’s so relaxing to curl up with a cup of tea (or glass of wine!) and tune into one of our favorite shows on HGTV. The only problem, though, is that while we binge-watch these popular house-hunting shows, we can start to believe that what we see is representative of our local real estate market. While…

If you or your spouse is an active United States military member or veteran, you may be eligible for a Veterans Affairs (VA) loan. VA loans are a popular type of mortgage for veterans because they offer loans for 0% down payment and do not require mortgage insurance. Additionally, VA loans generally have fewer upfront…

Mortgage rates dropped yet again, and buyers across the country are carefully watching the market to see if rates will increase sharply before the busy spring market. While it’s hard to accurately predict rates more than six months in advance, industry experts speculate that they won’t climb above 4% in 2017. The nation’s most popular…

To say that we’re lucky to have Colleen Whitlock on the EveryHome team is an understatement! While she just joined our team earlier this year, she has a varied real estate background including experience in home staging. She’s already represented a number of buyers and sellers with EveryHome, and we look forward to her continued success in…

The holiday season is busy enough as-is, but it can feel even crazier if you’re also actively looking for a new home! While the real estate market typically slows down in November and December, this year is far busier than most. This is likely because the spring market was so competitive, and as a result,…

With chilly winds and cooler temps, it’s a great time of year to enjoy a warm, hearty meal in a cozy restaurant. Luckily, there’s no shortage of award-winning eateries in and around the city of Philadelphia! Here are a few of our favorite spots in the surrounding counties: The historic Kimberton Inn in Chester County offers…