If your petite townhome with a barely-there backyard isn’t cutting it for your growing family, you’re not alone! Here’s how to easily make the jump into your single-family “forever” home: 1. It just might be more affordable than you think. Mortgage rates are hovering near historic lows, and (depending on when you purchased your last…

Have you heard the story about your second cousin’s best friend who submitted nine offers before finally (finally!) securing their dream home? If you’ve heard it once, you’ve heard it a hundred times: buyers are struggling to get offers accepted, especially in hot markets like Lafayette Hill, Ardmore, Glenside and Ambler. This tends to especially affect first time buyers….

Who needs a vacation when you live in one of these gorgeous Greater Philadelphia staycation homes? From the rolling hills of Chester County to the horse farms and historical districts of Upper Bucks, we’ve scoured the region to find you the best properties for relaxing, unwinding, and taking a little time off: Step back…

Does Memorial Day Weekend have you dreaming of a beach house? If you’re itching for a budget-friendly waterfront property this summer, be sure to check out our favorite local beach towns that you can actually afford: Peaceful, relaxing, and friendly! Brigantine is located in Atlantic County, New Jersey and the island community is known for its…

It’s not uncommon for married or unmarried couples to have different credit scores. If the difference is just ten or twenty points, it’s unlikely to affect you when buying a home. But what happens if your credit score is a sparkly 760 and your significant other has a credit score of 620, for example? This is where…

Homes are selling quickly in Greater Philadelphia, and it’s not uncommon to see homes go under contract within a day! While we often see homes sell in less than a week during the springtime, we’re currently seeing even more competition among buyers than usual. Most real estate agents attribute rising home prices and quick sales…

If you’re obtaining a mortgage for your new home, you’ll likely be making a down payment. While some loan types don’t require a down payment (namely, VA or USDA loans), the vast majority of borrowers are required to pay at least 3.5% towards their new home at settlement time. If you’re able to pay 20%…

Chester County is filled with scenic villages, historic districts, and beautiful walkable towns. EveryHome Maureen O’Shea, a long-time resident of the area, shares with us her favorite “hidden gem” in Chester County. Maureen’s favorite spot in Chester county is Marshallton. As Maureen explains, is a cute little town just west of West Chester that is still…

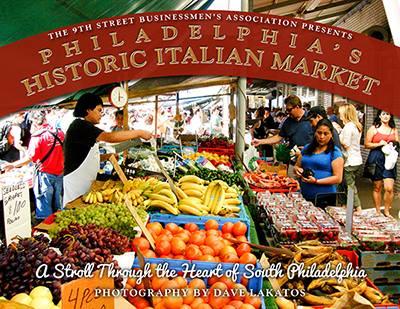

Food lovers, rejoice! Philadelphia is home to some of the greatest restaurants and eateries in the country, and we’re planning to celebrate them all month long: The 9th Street Italian Market Festival will be coming to South Philly on May 21st and May 22nd. The non-ticketed (free to enter!) event will celebrate the flavors of…

If you’re looking to purchase a “fixer-upper,” you just may want to consider the government-backed FHA 203k loan! The FHA 203k loan is a special type of rehab or renovation loan that allows buyers to borrow money for the purchase price of their new home and the necessary renovation costs. In essence, this loan…

It’s no secret that South Philly real estate is hotter than ever! Local EveryHome Realtors and South Philly experts Mark Gatta and Anthony Fanelli weigh in on their favorite neighborhoods in the area. Mark Gatta explains that the Newbold section of South Philly is his favorite — and not just because he owns and operates…

Beer lovers, rejoice! Local residents know that the City of Brotherly Love is renowned for its craft breweries and tap houses, and this weekend’s celebrations highlight some of the “best of the best” in the region. Here’s what’s on tap: Don’t miss out on Hawthorne’s Annual IPA Block Party this Saturday! On May 14th, the Bella…

The average 30-year fixed rate conventional mortgage is hovering just above a 3-year low, Mortgage News Daily reports. Borrowers across the nation can expect to lock in at a rate of approximately 3.625% — not too shabby! This rate is close to the all-time lows that the mortgage industry experienced in 2012-2013. FHA and VA loans…

Bridge Street is located in the center of Phoenixville and is considered the entertainment hub of Chester County. Lined with award-winning shops and eateries, Bridge Street is a popular spot for residents and visitors alike! There’s no shortage of restaurants in Phoenixville , but Marly’s BYOB just might be our very favorite. With one of the…