The rule formally known as “TRID” (TILA-RESPA Integrated Disclosure) officially took effect this past Saturday. Spearheaded by the Consumer Finance Protection Bureau, the new guidelines for lenders are intended to help the buyer/borrower better understand their mortgage terms.

Here’s what you can now expect to see:

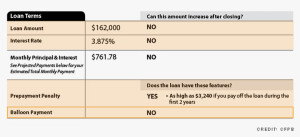

–A Loan Estimate Form will be provided to you within three days after applying for a mortgage. This three-page document explains the basic loan terms, including the amount, the interest rate, and whether or not the terms may change after settlement. This form (pictured below) should help you better shop around and compare loans from different lenders.

Image via Consumer Financial Protection Bureau

–The Closing Disclosure Form will be provided to you three days prior to settling on your new home. This document should closely match the Loan Estimate Form, and will provide greater information on monthly payments and other loan details. This form is a welcome change for many buyers; previously, some lenders didn’t provide this information until the day of settlement or the day before!

For more helpful information, be sure to visit the Consumer Financial Protection Bureau.