Montgomery County Restaurants Who doesn’t love a delicious meal at one of the many great montgomery county restaurants? Here are a few of our favorite montgomery county restaurants, in no particular order: 1. 19 Bella in Skippack never disappoints! This “Tapas” restaurant is consistently one of our favorite places for a nice night out in…

Ever wonder what your real estate agent is really thinking? Here are the five things that we hope to instill in every client: Not all $200,000 homes cost the same! Instead of thinking about your budget in terms of the sales price, consider the amount you’ll pay monthly. A home’s affordability can be greatly affected by…

Have you heard of “dual agency”? This real estate word refers to a transaction in which the buyer and seller are represented by the same agent. In other words, the agent who is negotiating on behalf of the buyer is really working for the seller! Since the agent’s original contract is with the seller and…

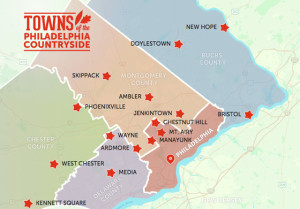

Visit Philadelphia (the city’s official visitor website) named the top 15 Towns of the Countryside! The charming small towns were chosen for their walkability, great attractions, natural beauty, and accessibility to the city. In fact, every town chosen is within an hour drive or train ride to the city! Image via Visitphilly.com The towns include…

PA Real Estate Market Report. The Pennsylvania Association of Realtors recently released housing statistics for the second quarter of 2015, and the market continues to steadily improve. Perhaps most notably, the median sales price increased 3.3% over this time last year to $175,500. Sellers are also benefiting from quicker sales; the average Days On Market decreased…

It’s that time of the year again! We love the idea of a “last hurrah” as summer comes to a close, and here are a few of our favorite family-friendly events before the little ones head back to school: 1. There’s nowhere on earth quite like the Franklin Institute. Philly’s favorite interactive science museum is now offering “The Art…

There are still plenty of short sales and foreclosed homes on the market, despite the housing market being largely recovered. While the bank is involved in both short sales and foreclosure, it’s important to know that these two terms are very different– and result in a far different buying process! Here’s how these distressed properties work:…

The National Association of Home Builders/Wells Fargo Housing Market Index has climbed to its highest level since 2005! The confidence index now sits at 61 points, which indicates slow but steady progress and an optimistic outlook among builders across the nation. Additionally, construction on new single-family homes soared 13% from June to July and has now reached…

The celebrated neighborhoods of Northern Liberties, Fishtown and Penn’s Landing will be offering their second annual Night Out Restaurant Week from August 21st until August 30th! The 21 participating restaurants include the award-winning Moshulu, Morgan’s Pier, Cantina dos Segundos, and Circles Thai. Lunch will be offered for $20 and dinner will be offered for just $35. Be…

The National Association of Realtors compiled a fun list of each state’s distinctive real estate feature, and we certainly agree with their conclusion about Pennsylvania. The Keystone State’s distinctive feature is (drumroll, please)… a big rear backyard! The list was compiled by a team of researchers who evaluated 1.5 million homes for sale and selected individual features…

If you’re looking to secure a mortgage for $417,000 or more, then you’re in the market for a “Jumbo” Loan! These jumbo mortgages refer to loans that are in excess of the limits imposed by government mortgage giants Fannie Mae and Freddie Mac. If the mortgage amount is higher than $417,000 (A few of the…

How to Survive a Scary Home Inspection Whether you’re buying or selling, home inspections can be scary. In fact, they almost always are! Why? Home inspectors are hired to find all issues, potential problems, and needed maintenance. Unfortunately, even brand new homes can have a list of hidden issues, and even the most meticulously maintained homes…

Searching School Districts We know how important it is to find a great school district, and we’re excited to offer helpful, new information on Everyhome.com to assist clients with their search! If you’re on the website regularly, you may have noticed that every school district in Chester, Montgomery, and Delaware County now offer each school district’s general…

Economic conditions are slowly returning to normal across the nation and many experts are speculating that the Federal Reserve may soon raise interest rates. In recent years, the Fed has attempted to promote economic growth by holding the Fed Funds Rate near 0.00% which has allowed businesses and consumers to borrow money cheaply. However, strong labor market reports,…

TRID Policies and Forms If you’ve been researching real estate or mortgages recently, you may have come across information about TRID – and how these new TRID policies and forms will be implemented on October 3, 2015. TRID stands for the Truth in Lending Act (TILA) and Real Estate Settlement Procedures Act (RESPA), Integrated Disclosure. This…