Adjustable Rate Mortgage Starting to Rise in Popularity

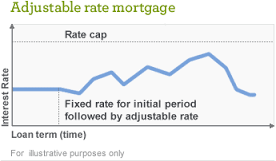

Thinking about securing an adjustable rate mortgage (ARM) on your new home purchase? You’re not alone! Five-year ARM rates remain extremely low at approximately 2.97%, and they’re even lower than a 30-year fixed rate mortgage because the bank is taking more risk to lend you money for a longer period of time. As the name implies, an adjustable rate mortgage interest rate will periodically fluctuate to reflect the current market.

While adjustable rate mortgage have risen in popularity lately, they only make up approximately 5.4% of new loan applications. This number is expected to rise in the coming months. image via wellsfargo.com

For some buyers, an ARM loan is a great option. However, generally speaking, if you know that you’ll be in your new home for longer than 10 years, then your safest bet is to a choose a 15- or 30-year fixed rate mortgage. As always, we recommend that you speak with your lending professional to determine the best option for your individual needs.