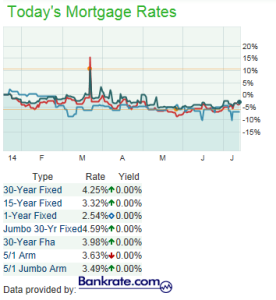

Why Have Mortgage Rates Remained Low?

Experts predicted mortgage rates to rise significantly in 2014, but instead they remain even lower than 2013. Why haven’t rates hit 5% as expected?

Supply and demand plays a big role. For starters, there have been fewer mortgages originated (largely due to lessened refinance activity), and fewer first-time home buyers in the market. Additionally, the low inventory of homes for sale have kept many buyers from finding their perfect new home. This relatively slow mortgage activity has helped to keep rates down.

Image via marketwatch.com and Bankrate

When the Federal Reserve announced last year that it would be tapering its purchase of mortgage backed securities, many industry professionals expected that this would cause interest rates to climb. While the Fed did begin purchasing fewer of these securities, it happened to occur at the same time that mortgage originations began to fall. This meant that fewer mortgage backed securities were being issued, creating a relative balance.

Other forces include weaker-than-expected economic reports and low inflation.

In the meantime, enjoy the process of home hunting knowing that rates remain affordable! Be on the lookout for economic reports, especially involving the job market or inflation. If either of those numbers jump markedly, we’ll know that higher rates are on their way!