What If My Spouse Can’t Qualify for A Mortgage? Let’s say, for the sake of argument, that your credit score is a sparkly 790. And your spouse’s? 620. While 620 isn’t out of the question for purchasing a home, it can definitely negatively impact your rate and other fees. Plus, it can lower your overall…

Buying Next Season? If you’re thinking about buying next season, then kudos to you for checking out Everyhome.com to see what’s out there! There are a few other easy ways that you can put yourself in the best possible position to purchase your new home: 1. Don’t be afraid to reach out to a local…

Selling A Home with A Dog Hi! My name’s Alanna, and I’m an EveryHome agent. My 10 month-old Goldendoodle, Norman, is the love of my life — but I have to admit that sometimes selling a home with a dog can require a bit of extra attention! Here are three things that I always ask…

Delicious Restaurants in Greater Philadelphia There’s nothing that we love more than discovering a great new restaurant, and we’d like to share a few of our favorites: 19 Bella in Skippack is a quaint, tapas-style BYOB with a changing menu and friendly service. 19 Bella in Skippack, PA Honey in Doylestown offers an eclectic, seasonal menu and…

Keeping Up With Your Credit Score Checking your credit score can be nerve-wracking, especially for younger prospective home buyers who may not know where they stand. While it can be scary, Carl Scaramuzza of Credit Blueprint recommends checking your credit score every six months to get a sense of where you stand and ensure there…

Top Festivals in Greater Philadelphia As always, this weekend is buzzing with festivals, fairs, and specials events all throughout the city of Brotherly Love! Here are a few of our favorites: -Philadelphia Zoo’s Summer Ale Festival on Saturday, July 19th. You heard right! Spoil the kids with a trip to the zoo while enjoying more than 40…

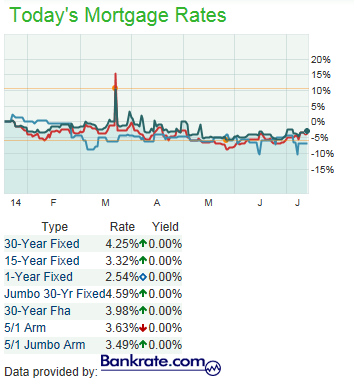

Why Have Mortgage Rates Remained Low? Experts predicted mortgage rates to rise significantly in 2014, but instead they remain even lower than 2013. Why haven’t rates hit 5% as expected? Supply and demand plays a big role. For starters, there have been fewer mortgages originated (largely due to lessened refinance activity), and fewer first-time home buyers…

Philadelphia and its surrounding counties saw a much-needed increase in inventory of homes for sale (an increase of 6.8% from this time last year), as well as a steady increase in median sale price. Here’s what we’ve seen so far this year: Philadelphia County Prices Median Settled Price: $136,000 (Increase of 1.49% from 2013) Avg…

Saving More On Homeowners Insurance Homeowners insurance is intended to protect you against any physical damage to your home, often including the structures on your property (such as a shed, pool, or detached garage) as well as your legal liability for any injuries that may occur on your property. If you’re shopping for homeowners insurance, be…

Choosing the Price for Your Next Home Consider this checklist before choosing the price for your next home: 1. How much are you comfortable paying? Using EveryHome’s helpful Closing Cost calculator is one way to determine your monthly payment, and your lender would be happy to provide a Good Faith Estimate (GFE) for you as…

Active Adult Communities in Greater Philadelphia Active Adult Communities (or “55+ Communities”) are prevalent in the suburbs of Philadelphia, and for good reason! These communities are designed with their residents needs in mind, and they typically offer convenient, low-maintenance housing in a peaceful neighborhood with plenty of activities and things to do! Most active adult…

Why Home Warranty’s Are Worth It Home warranties are an easy and affordable way to preserve peace of mind. Different from homeowner’s insurance, a home warranty is a service contract that covers the repair or replacement of most appliances and system components in your home. The way that they work is simple. When you have…

July 4th Festivities! Head to America’s birthplace for July 4th festivities! The popular parade will begin at 11am at 5th & Chestnut Streets, and conclude at Front & Market Streets. Fireworks will be held over the Philadelphia Museum of Art on July 4th beginning around 10:30pm. Image via G. Widman for Visit Philadelphia On July 5th,…

Moving and Selling At The Same Time It’s not uncommon for EveryHome clients to be moving and selling a new home in the same day or week. Since many homeowners must sell their home in order to purchase a new one (as required by their mortgage lender), there are many options for families in such a…